Advice from our consultants for Dynamics 365 Business Central

Most businesses record the invoices received from vendors as a Business Central “Purchase Invoice“, or as details on the “Purchase Order”. These invoices could be for goods received (as raised from a Purchase Order), for sundry goods/services (for example electricity or telecommunications), or for an “instant” purchase of goods.

Sometimes, however, the vendor will calculate a slightly different GST amount to that calculated by Business Central. This is because different computer systems calculate GST differently, and it is not unusual to have a few cents difference on a complex invoice. One way to address the issue is to simply post a manual journal for the difference, but this involves more work, and possibly co-ordinating between the AP and finance departments (and maybe even the vendor themselves).

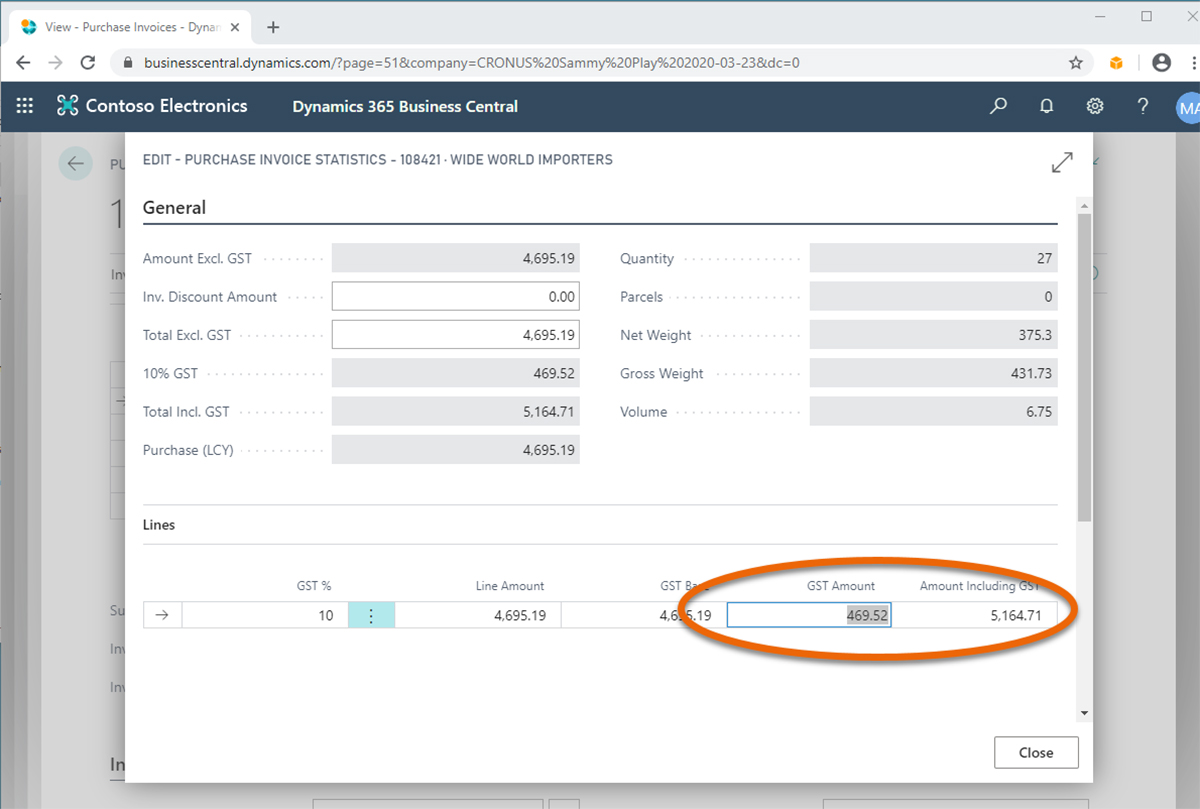

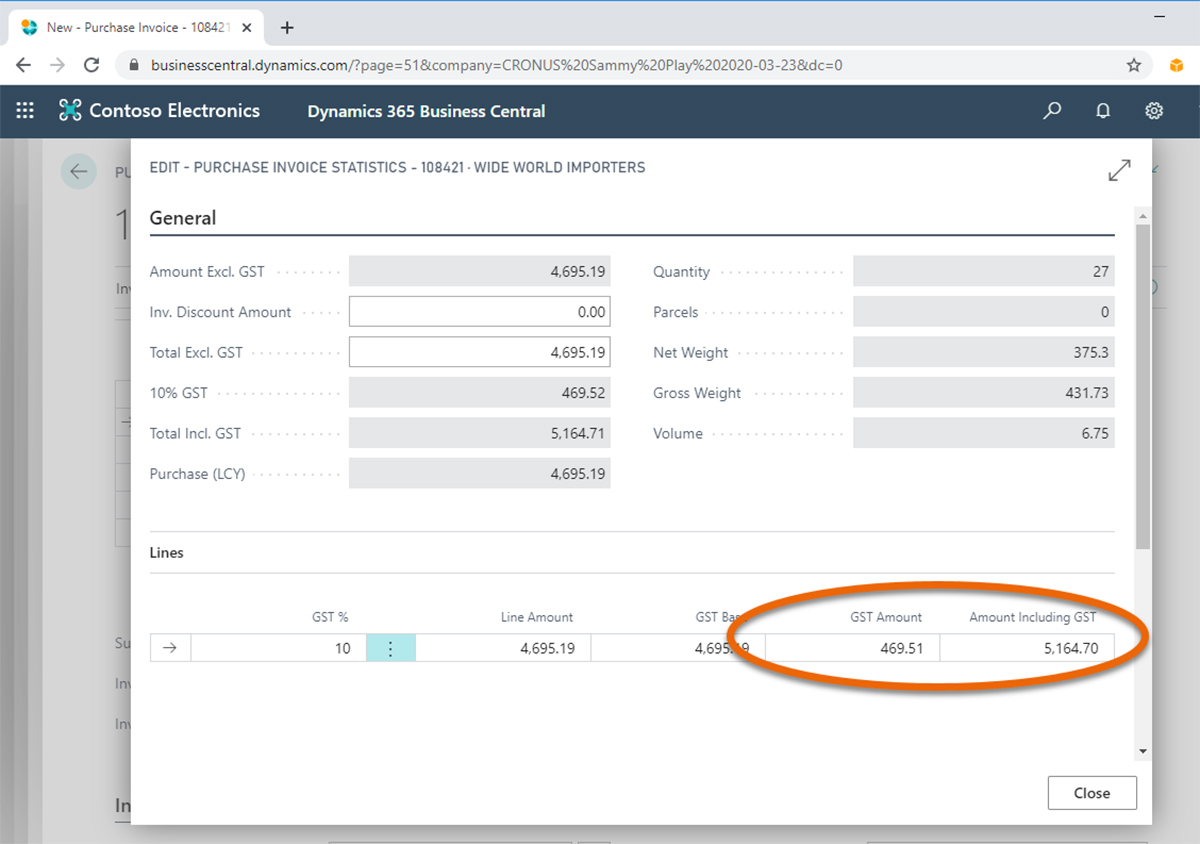

However, in Business Central, there is a method to manually override the calculated GST. The system even keeps a record of the difference which was entered manually! Importantly, this function is only available if it is setup in the configurations, and also if the user has security permission to make these changes.

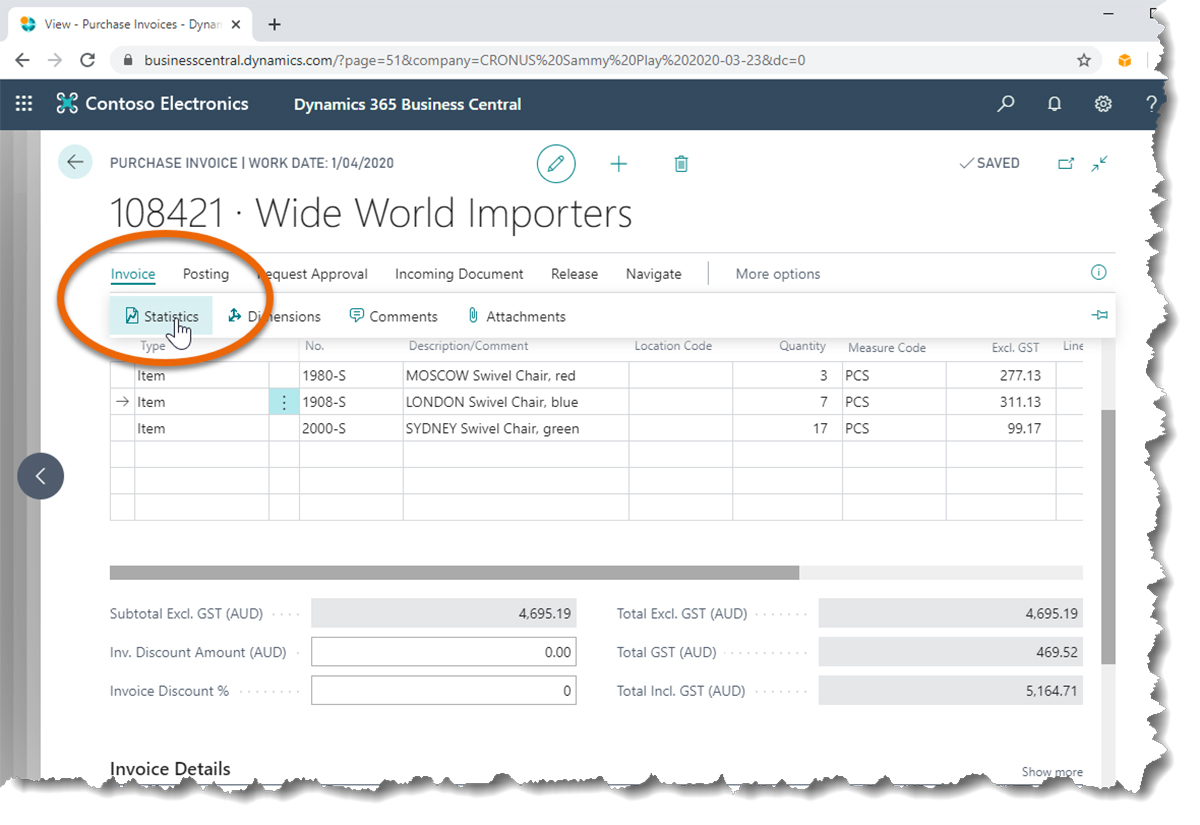

From a Purchase Invoice or Purchase Order, open the Statistics page (first image below), look at the Lines FastTab, and at the GST Amount field. It shows the GST as calculated by Business Central. If required, simply click in the field, and change the amount (second and third images below). In the pictured examples, the invoice was for $4,695.19 (before GST) and Business Central calculated the GST to be $469.52. But the vendor’s system calculated GST to be $469.51, so the GST can simply be changed in the Statistics Page.

Everything else is now handled invisibly, automatically, and without any fuss, as is typical of Business Central.