Migrating to a new Finance/ERP system is usually a very demanding project in terms of time and effort. Most of this time and effort is usually spent on identifying the key system requirements and in populating the data migration templates.

The system validity and data integrity of the new system is often dependent upon how well structured and well maintained the legacy system and its data is. It can often become a challenge to extract this data and transform it into a format that is acceptable by the new system. It becomes even trickier if the new system forces you to restructure your master data, e.g., chart of account, to populate its data migration templates.

In this blog, we will discuss some of the ways that can help you prepare for the system migration to Microsoft Dynamics 365 Business Central.

Chart of Account

The backbone of any General Ledger system is a good solid chart of account that not only allows you to expand it as and when required, but also enables you to design a structure around it so it delivers more than just a list of G/L accounts.

Business Central chart of account enables you to slice and dice your G/L account balances to get to your important numbers—e.g., Total Cash in hand, Vehicles at Cost, Sales Income or Payroll Expenses—without the need of a sophisticated reporting tool. The components that make Business Central chart of account so powerful include:

- Natural Accounts.

- Dimensions.

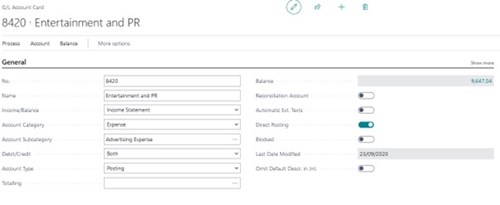

- Account Type.

- Category / Subcategory.

- Income/Balance.

- Totalling.

Things to Consider

Segmented Chart of Account

We would suggest that, when migrating to Business Central, if your existing chart of account is a segmented chart then identify which of the segments are key segments that must be keep in the new system. In Business Central, segments would normally be converted into Dimensions and Values.

You must ask these questions when creating your chart of account:

- Is there any segment for which you generate reports e.g., P&L by Department?

- Is there any segment that applies to accounts across the range of your chart e.g., Entity?

- Is there any segment that you use to produce a subset of your P&L or other management reports?

Global Dimensions and Shortcut Dimensions

In Business Central, there are eight different dimensions (or segments) that can be configured and attached to the invoices and/or the general journal transactions. The segments of your chart of account can become dimensions in Business Central, with two of these configured as Global Dimensions. The Global Dimensions are the dimensions that are key to your business activities and reporting needs, e.g., Entity and Cost Centre. The rest of the dimensions are called Shortcut Dimensions (not a Global Dimension) and can also be used to generate reports in Jet.

Adding a Structure to your Charts

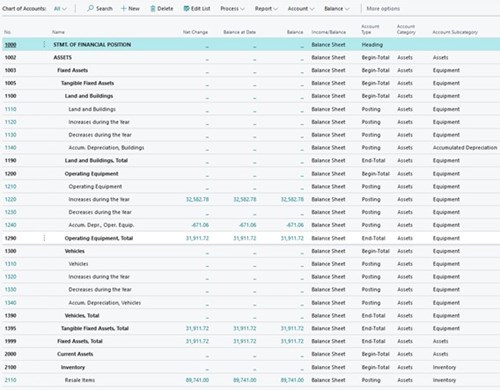

In Business Central, you can create a flat chart of account, enabling you to design a structured chart of account; see the example below.

The Account Type property of the chart of account can be used to create a structured view of your Chart. This requires the setup of a few G/L accounts that will only be used for the structure (Heading, Begin-Total, End-Total), and not for the data posting. These G/L accounts can also be used to create a filtered view of your chart and easily check the total balance of any section of your chart, e.g., Total Fixed Assets, Total Bank, Total Income, etc.

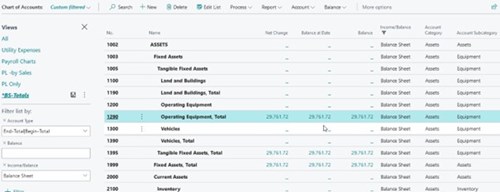

Account Category and Subcategories

Account Categories and Subcategories are a functionality that provides the ability to create groupings of the charts to help with the reporting. For example:

Categories |

Subcategories |

|---|---|

| Asset | Current Asset |

| Inventory | |

| Equipment | |

| Liability | Current Liabilities |

| Payroll Liabilities | |

| Trade and Other Payables | |

| Expense | Marketing Expenses |

| Utilities Expenses | |

| General Operating Expenses |

These categories and subcategories help generate reports and reduce the manual effort required to maintain or update these reports for when you create new G/L codes.

Additionally, you can use the categories and/or subcategories to filter your chart to view the balance or create a filtered view, for example, when you only want to work with a particular section/group of accounts.

Auto-numbering

Creating master data with manually assigned numbers can be tedious. Business Central enables the auto-numbering of the master data. However, this may result in the need to re-number all your Customers, Vendors, and Fixed Assets to be able to use the Business Central auto-numbering functionality. Changing the master data codes can have a bigger impact not only on users doing the data entry and raising invoices, but also on the third party systems interfacing with your G/L system as the master data codes will need to be synced in all the interfacing systems as well.

This situation can be easily managed with a custom field and mapping table in Business Central that you can discuss with our experts during design workshops.

Emailing

Business Central can email out invoices, statements, reminder letters, and remittance advices to Customers and Vendors. Migrating to Business Central provides a good time to ensure that you have valid email addresses for your customers and vendors so you can make full use of the system functionality and improve on process efficiencies.

This may not be the complete list of things to consider when migrating to Business Central, but it will certainly give you a head start. It will help you in deciding how you want to structure your master data in your new system, and should also help in filling in data migration templates with more accuracy and reducing data integrity and validation errors during actual data migration.