Using EFT to make payments eliminates the hassles and costs of using paper checks, but it introduces new avenues for fraud. While consumers have up to 60 days to identify fraudulent activity on an account and recover the funds, the rules for businesses are different, and you can have as little as one or two business days. That short time frame for identifying fraud, and the reality that wire fraud is on the rise, means it is especially important for companies to implement practices that will protect them.

Some of the practices that you use to protect your paper-based payment processes, such as an approval process and separation of duties, can be applied to electronic payments with only a few tweaks. In addition to those standard steps, you will want to take additional measures to minimise your risk.

Here is a look at two practices that will help protect you from EFT fraud.

1. Implement an approval process for adding and modifying vendor bank details. This scenario is becoming increasingly familiar as people find smarter ways to siphon money from organisations:

- Vendor invoices are entered into the financial system.

-

- Approval received.

- Bank details for vendors are updated in the financial system.

- No approval rules are in place.

- Vendor payment created.

- Invoice checked for previous approval.

- Payment approved.

- Months later, the vendor calls stating payment had not been received.

- Checks uncover bank account did not belong to the vendor.

- Problem employee left the organisation OR

- Problem employee pays future invoices to mask the previous loss of funds.

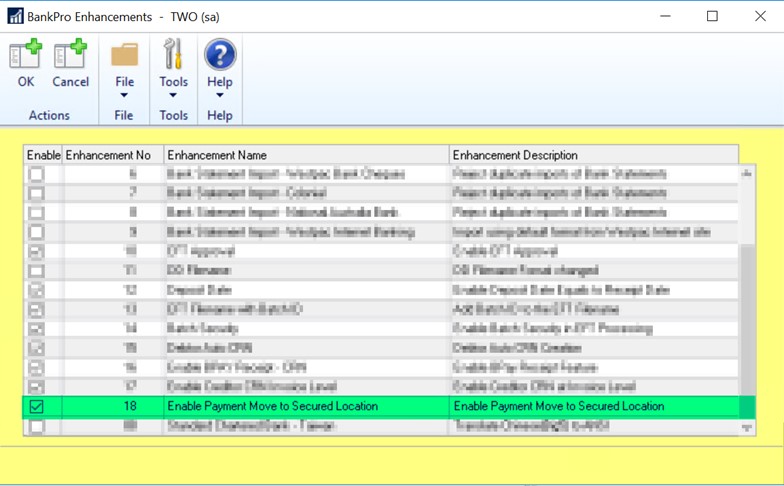

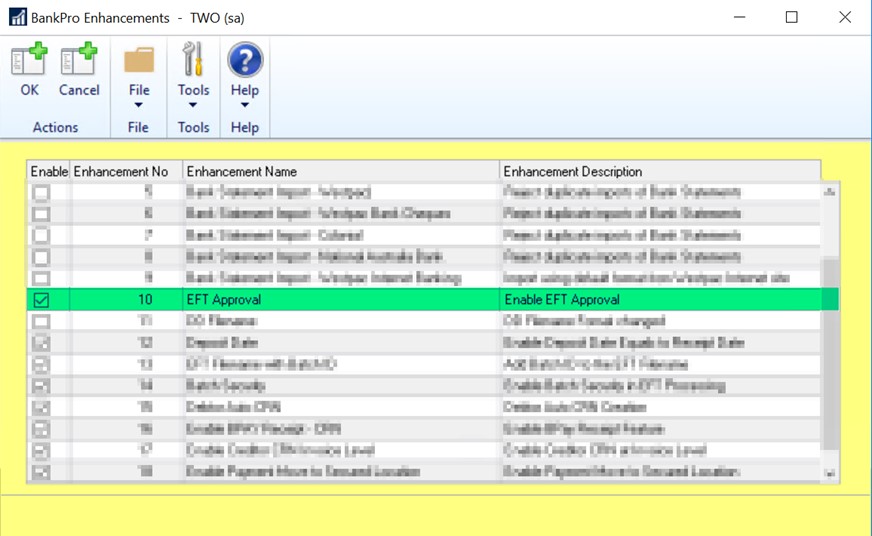

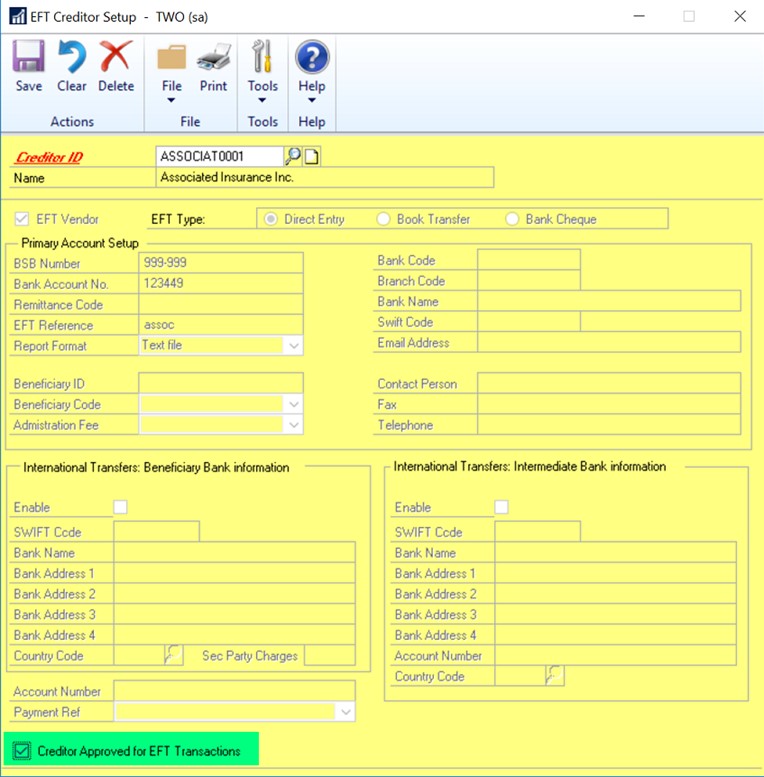

With BankPro Enhancement feature, you can ensure a creditor cannot be paid using an EFT payment (if EFT approval has been activated) unless the creditor has been approved for EFT transactions.

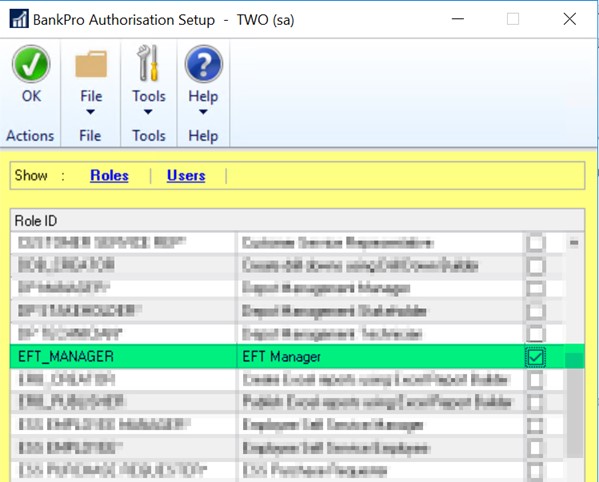

A user MUST have security granted before they can process an approval. This will ensure your vendor bank information is secure from criminal activity.

You can apply security to the EFT Creditor Setup window to restrict selected users/roles from entering EFT information for a creditor as well as for viewing only the information.

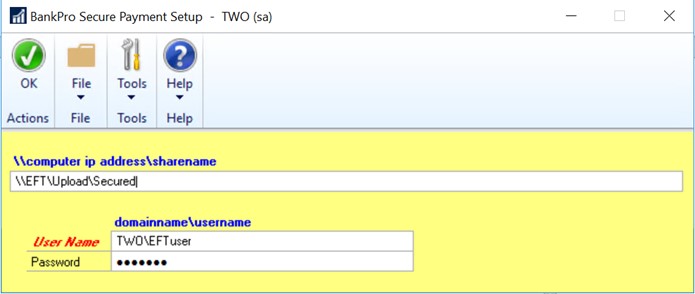

2. Automatically save EFT files to a secure network location with read-only rights. This prevents users from being able to manually change the content in the file before uploading to the bank.

The BankPro Payment Move to Secured Location feature allows you to nominate a shared secure network drive set up by your IT Team.